Depok-The deadline for reporting the Annual Personal Income Tax Return (SPT) for the 2023 Tax Year is getting closer, namely March 31, 2024. To ensure that the general public follows the correct SPT reporting process, the Tax Administration study program, Vocational Education Program, Universitas Indonesia (UI) through the UI Tax Clinic provides free SPT filling consultations. This service, which is open from March 4 to March 28, 2024, is part of the Tax Action 2024 program.

SPT reporting consultations can be done at the Tax Clinic, Business Center Building, 1st Floor, UI Vocational Education Program. However, in the third week (March18–22, 2024), consultations were held on the ground floor of the University Administration Center Building (PAU), UI Depok Campus. During Ramadan, this activity is open every Monday to Friday (except national holidays), at 08.00–16.00 and 08.00–15.00 Western Indonesian Time (WIB).

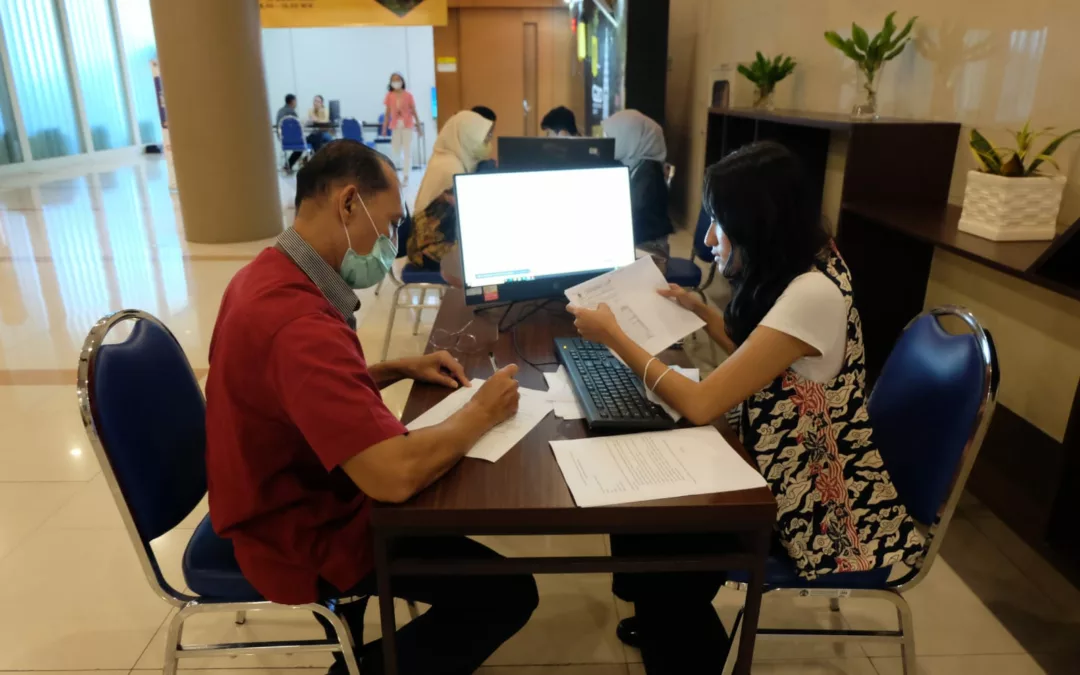

(Photo: Tax Administration lecturers and students providing tax reporting assistance for UI academics)

(Photo: Tax Administration lecturers and students providing tax reporting assistance for UI academics)

According to the person in charge of the UI Tax Clinic who is also the Head of the UI Tax Administration Study Program, Thesa Adi Purwanto, S.Sos., M.TI., this activity is a form of service to the community service. “If individual taxpayers go to a tax consultant, they will definitely be charged for assistance in filling out individual tax returns. For this reason, we provide completely free services as a form of community service,” he said.

A total of 90 UI Tax Administration study program students accompanied by 5 lecturers were deployed to assist the general public in reporting SPT on the djponline.pajak.go.id page. As of March 20, 2024, the service team has served more than 400 taxpayers. In this case, the taxpayer is an individual who has income above Non-Taxable Income (PTKP). Based on Income Tax (PPh) Article 21, the taxpayer’s income is withheld by the employer, and at the end of the year the taxpayer must report the deduction via SPT. There are three types of SPT for individuals, namely SPT 1770 Very Simple (SS), SPT 1770 Simple (S), and SPT 1770.

“The three types of SPT have different structures. SPT SS is intended for employees with income of less than IDR 60 million per year (gross), the SPT is only one page. SPT S is intended for taxpayers who have one or more employers, for example having two types of income and a total of more than IDR 60 million per year. It’s not one page, but there are attachments for other income outside of fixed income. Meanwhile, SPT 1770 is intended for taxpayers who open their own business or have freelance work. This needs to be calculated by yourself because it is not calculated by the employer. So, the Tax Administration study program lecturers will supervise students in filling out SPT 1770,” said Thesa.

The SPT filling consultation service at Tax Action 2024 has a flow that must be followed. Taxpayers who want to consult can register via the link bit.ly/TAXACTION2024. To facilitate the service process, taxpayers are expected to prepare several documents, such as Electronic Filing Identification Number (EFIN), Taxpayer Identification Number (NPWP), Resident Identification Card (KTP), Family Card (KK), 2023 Withholding Proof, financial report (for those who own a business), and recapitulation of gross circulation (for lawyers, actuaries, notaries, doctors and architects).

(Photo: Tax reporting assistance for the general public at the UI Depok Campus)

(Photo: Tax reporting assistance for the general public at the UI Depok Campus)

Next, the service team will check the completeness of the data and collect Proof of Withholding for 2023. For UI employees, proof of deduction can be downloaded via the UI Human Resource Information System (HRIS) website. Meanwhile, for the general public, they need to bring a printed copy of the cutting proof. The team helps taxpayers log in to the DJP Online site using their EFIN number, then provides a tax calculation simulation based on withholding receipts. If the data is complete, the SPT reporting has been successful. However, if there is still an underpayment, the taxpayer must pay the tax via e-banking.

In addition to reporting Personal Income Tax Returns, the UI Tax Clinic will provide services for filling out Annual Corporate Tax Returns, the deadline for which is April 30, 2024. The Annual Corporate Tax Return consultation is planned to be paid, but at a price below that of other tax consultants considering the function of the UI Tax Clinic as a teaching factory. The UI Tax Clinic also provides various other tax services, such as monthly Value Added Tax (VAT) services, PPh Withholding and Collection (Potput), and tax reviews.