Depok-Every taxpayer (WP), whether individual or corporate, is required to report their Annual Tax Return (SPT) on time before the due date. This year, the deadline for reporting SPT is March 31, 2024. The Directorate General of Taxes (DJP) of the Indonesian Ministry of Finance noted that 5.41 million taxpayers had reported their annual tax returns as of February 28, 2024. The number of taxpayers reporting the 2024 SPT increased by around 1.63 percent compared to the same period last year.

In order to facilitate the public to understand the correct SPT reporting process, the Tax Administration study program, Vocational Education Program, Universitas Indonesia (UI) through the Tax Clinic is again holding Tax Action 2024. In collaboration with the UI Vocational Taxation Student Association (HMP), Tax Action 2024 aims to provide free consultations on filling out Annual Personal Income Tax Returns (Tax Year 2023).

This community service activity has been carried out regularly for the last eleven years. The consultation assistance was provided by five lecturers and 89 Tax Administration students on a voluntary basis, who provided assistance and consultation on filling out SPT for UI academics and the non-UI community (general).

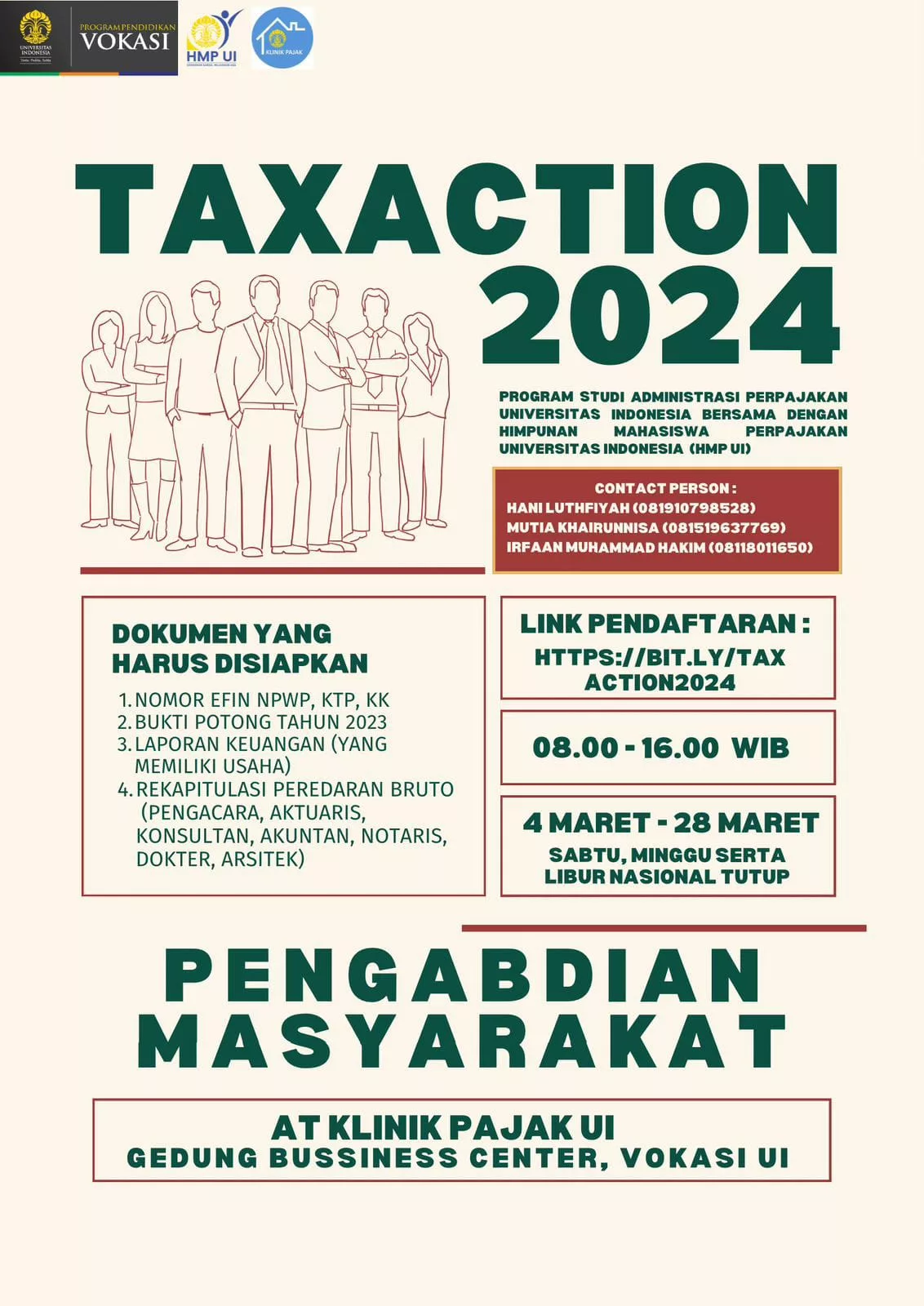

(Photo: Tax Action 2024 Poster)

(Photo: Tax Action 2024 Poster)

Tax Action 2024 is open to the public and is scheduled to take place from March 4 to March 28, 2024 at the Tax Clinic, 1st Floor Business Center Building, UI Vocational Education Program, UI Depok Campus. This activity will be held every Monday to Friday (except national holidays), from 08.00 to 16.00, and 08.00 to 15.00 during the month of Ramadhan.

Apart from doing it face to face, taxpayers also have the opportunity to receive online assistance and consultation via Zoom every Thursday during this period. Taxpayers who want to get a free consultation can register via the link bit.ly/TAXACTION2024.

To facilitate the service process, taxpayers are expected to be able to prepare several required documents, namely Electronic Filing Identification Number (EFIN), Taxpayer Identification Number (NPWP), Resident Identification Card (KTP), Family Card (KK); Proof of Cut in 2023; Financial reports (for those who own a business); and Recapitulation of gross circulation (for lawyers, actuaries, notaries, doctors and architects).

This year, the Tax Clinic will also immediately accept Corporate Income Tax (PPh) consultations for companies or industries. Registration for Corporate Income Tax consultation will provide further information via the Instagram account @klinikpajakui.

Director of the UI Vocational Education Program, Padang Wicaksono, S.E., Ph.D, stated that Tax Action 2024 activities could be a forum for students to practice learning in class. “Students’ participation in this activity can provide valuable knowledge and experience for them before entering industry after graduating. I am sure that UI Vocational students will provide quality services during consultation and mentoring. I hope that the general public can feel the great benefits of this annual community service program. ”

“Through assistance by lecturers and students, this community service is expected to be able to help taxpayers who have difficulty reporting SPT,” said Head of the Tax Administration Study Program, Thesa Adi Purwanto, S.Sos., M.T.I.