Depok-The Tax Administration study program, Vocational Education Program, Universitas Indonesia (UI), held a guest lecture entitled “Unboxing PMK No. 81 of 2024” and presented Daniel Bellianto, a tax consultant at Ortax who is also an alumnus of the Tax Administration study program, as a resource person. The guest lecture held on March 6, 2025 aims to invite students to understand the regulation for practice in the field of taxation.

Head of the Tax Administration Study Program, Thesa Adi Purwanto, S.Sos., M.T.I., said that the Regulation of the Minister of Finance (PMK) is one of the guidelines in the world of finance and taxation in Indonesia. Therefore, students need to study the various latest regulations issued by the Indonesian Ministry of Finance. Thesa said, “In accordance with the UI Vocational curriculum which focuses on practice, students need to understand the latest policies before they are implemented in society later. The presence of industry practitioners is also a strategic effort in studying these policies and their implementation in society,” said Thesa. This guest lecture is also integrated with the Taxation Systems and Procedures course. It is hoped that students can implement knowledge related to the various taxation systems and procedures that apply in Indonesia.

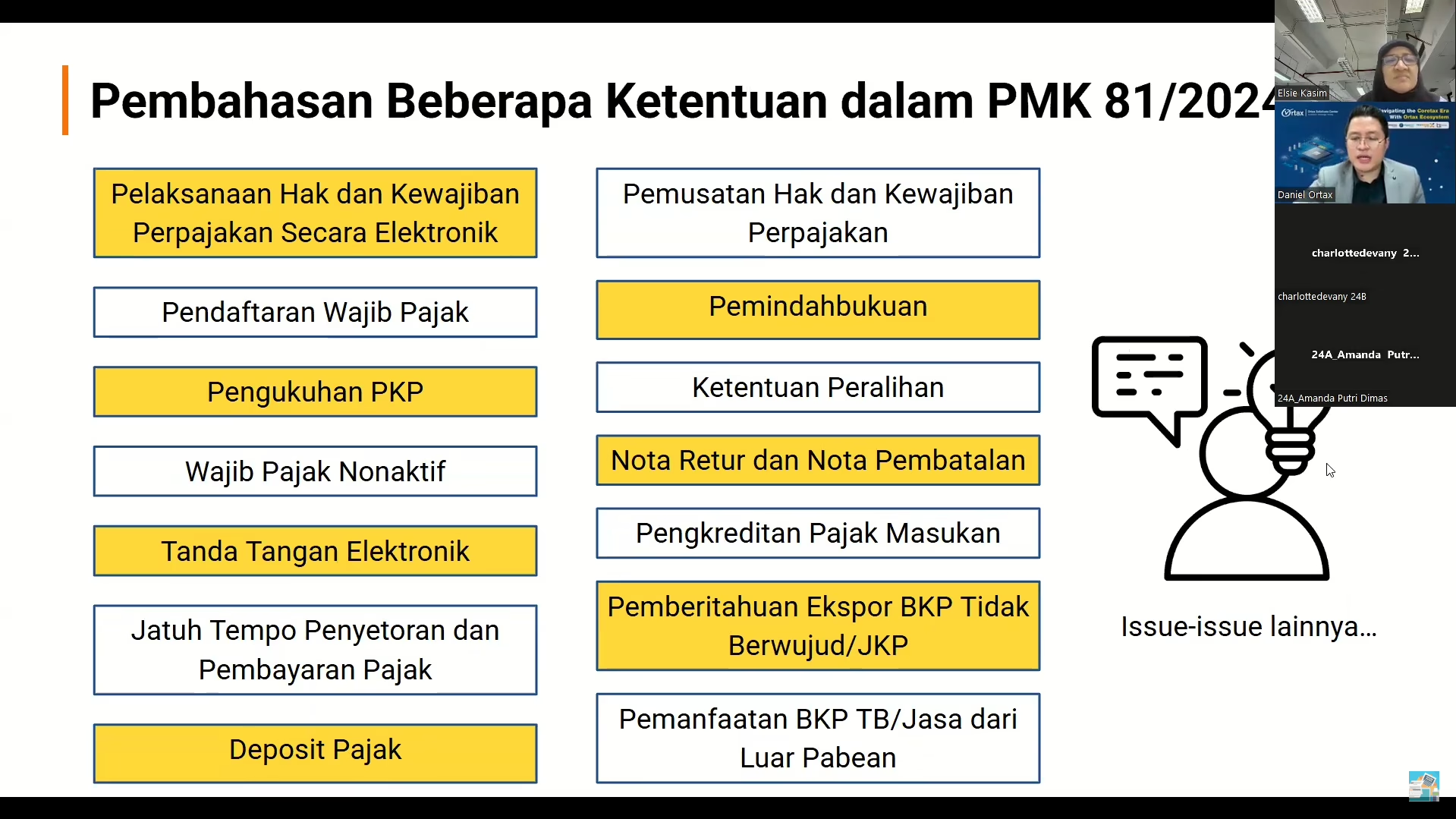

PMK is a decision that contains the policies of the Ministry of Finance and is the implementation of higher or equivalent regulations. PMK has a major influence on the financial sector, especially in taxation. Therefore, the government is making regulatory changes by strengthening the taxation system through this policy. PMK 81/2024 is one of the important regulations in the Indonesian taxation system that uses the omnibus law concept. This method is in the form of compiling regulations that combine or revise many rules in one main regulation in order to simplify and accelerate policy implementation.

(Photo: Several provisions related to PMK 81/2024 delivered by Daniel)

(Photo: Several provisions related to PMK 81/2024 delivered by Daniel)

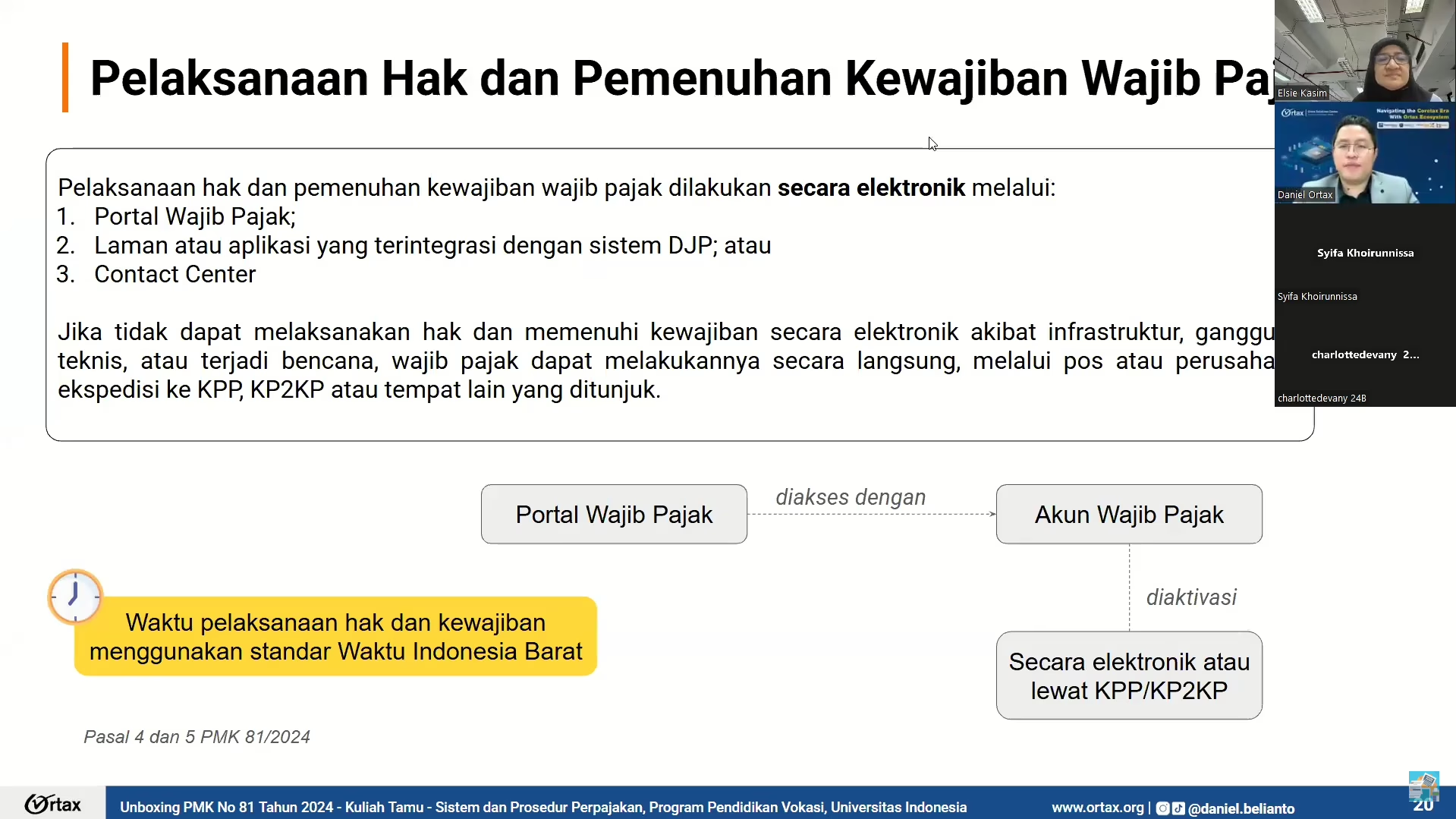

PMK 81/2024 presents a major transformation in the Indonesian taxation system, especially in the digitalization and integration of administrative processes. In today’s digital era, all tax administration processes must be carried out online. Daniel said, “The Directorate General of Taxes authorization code or electronic certificate attached to an individual that has been electronically signed is considered legally valid. Legally, this has been regulated in PMK 81/2024. This material not only provides an overview of technical changes, but also educates students to understand the differences between the previous system (legacy system) that was used and the Ortax digital system that will be implemented.”

The government continues to accelerate the digitalization of tax administration by enacting PMK 81/2024, which eliminates the obligation for taxpayers to come directly to the Tax Service Office (KPP). Now, the entire tax process is carried out electronically, including registration, reporting, and issuance of tax documents. The existence of this regulation shows that the government is strengthening the digital-based tax system through ortax, eliminating manual administration, and increasing efficiency in tax reporting and payments. This system not only accelerates the tax process, but also reduces the potential for administrative errors and increases taxpayer compliance.

(Photo: Daniel explains the rights and obligations of taxpayers)

(Photo: Daniel explains the rights and obligations of taxpayers)

Daniel added, “Tax decisions and documents that were previously sent in physical form have now completely switched to electronic format. Some documents that are now electronic include Tax Bills (STP), Underpayment Tax Assessment Letters (SKPKB), and Tax Assessment Letters (SKP). The consequence of this digitalization is that the date sent will be the same as the date received. This ensures that taxpayers cannot argue that documents are received late.”

Through this system, all tax communication and administration becomes more transparent and efficient. These electronic documents also need to use electronic signatures. Digital signatures are needed for various purposes, such as issuing tax invoices, creating withholding evidence, and reporting Annual Tax Returns (SPT).

Finally, Daniel said that the existence of PMK 81/2024 makes the Indonesian tax system increasingly digitally integrated, providing various conveniences for taxpayers in carrying out their obligations. “This digitalization allows the taxation process to be carried out more efficiently, starting from registration, reporting, to paying taxes without the need for direct face-to-face meetings with tax officers. Through a more automated system, the risk of administrative errors can be significantly reduced, thus ensuring that the entire taxation process runs more accurately and on time,” said Daniel.