Depok-Public understanding of insurance is still lacking, thus encouraging various parties to make a massive insurance literacy movement. Based on the results of a survey conducted by the Financial Services Authority (OJK), the insurance literacy rate of the Indonesian people was at 19% in the 2016-2019 period. OJK as the regulator of the insurance industry in Indonesia said that the Covid-19 pandemic was the right moment to increase public awareness and literacy regarding risk management.

Realizing this condition, the Insurance and Actuarial Administration Study Program, Vocational Education Program, Universitas Indonesia (UI) held an inbound-outbound lecture entitled “Risk Management: Handling Risk with Insurance as a College Student” on Friday, July 27 2022 virtually. The activity, which was packaged in the form of a public lecture, presented the Vice Chancellor of Genovasi University College, Malaysia, Prof. Dr. Mohd Taipor Bin Suhadah as speaker.

In his presentation, Prof. Taipor explained that insurance is useful for reducing, even eliminating uncertainty. “The effect of uncertainty is a situation that occurs not as expected and can be positive, negative, or both. It can generate opportunities or even overcome threats. To respond to this, there is a process to identify, measure, and form a strategy to manage a risk, namely the risk management process,” he said.

Then, Prof. Taipor said that risk management includes identifying risks, the occurrence of events, then analyzing the risks for the potential for their occurrence, and the impact of losses that may be caused. The next step is to evaluate the overall risk in the form of risk classification into the highest or lowest risk level. Finally, determine one of the four risk management options, namely controlled, transferred to other parties, self-financed, or avoided.

In making an insurance claim, not all risks can be covered by insurance, such as HIV disease, disease due to drug abuse, planned accidents, natural disaster events, and others. Insurance is needed by people of various ages, but the forms of insurance that are chosen vary according to their individual needs.

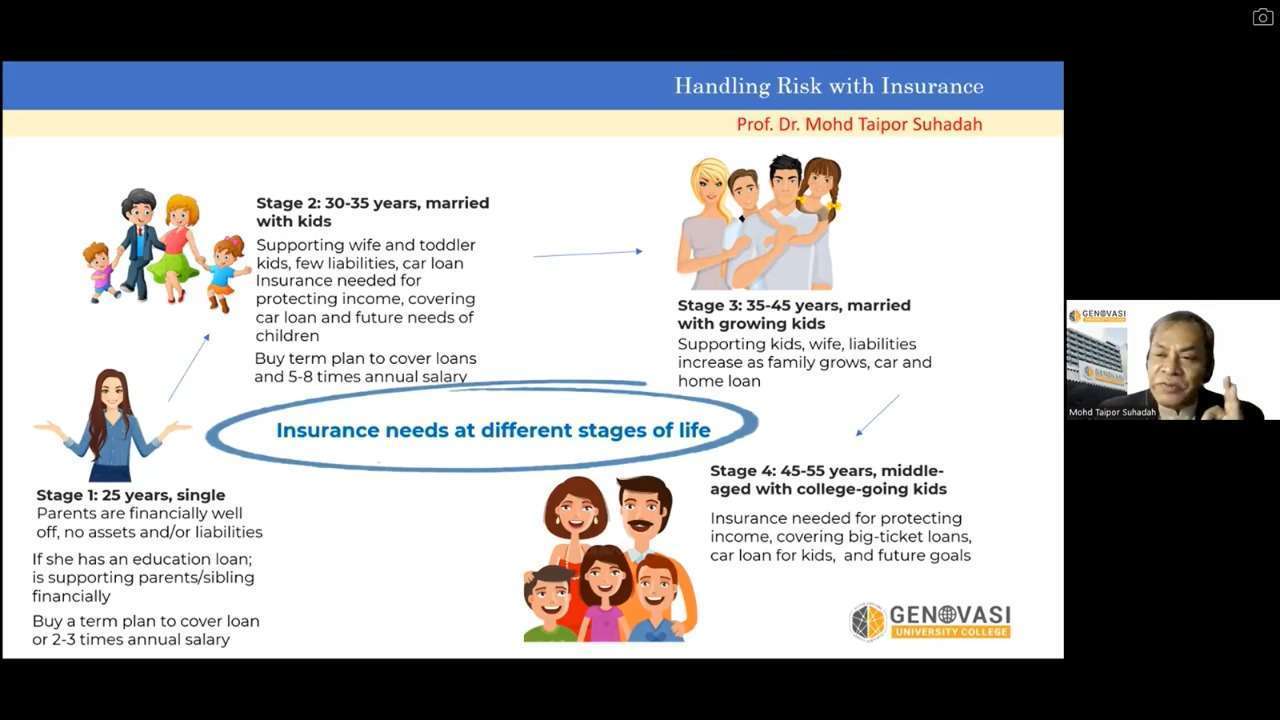

(Photo: Prof. Taipor conveys the four stages of insurance that everyone needs)

(Photo: Prof. Taipor conveys the four stages of insurance that everyone needs)

According to Prof. Taipor, there are fourstageson the insurance that everyone needs.First stage 25 years single; second stage 30-35 years old are married and have children; third stage 35-45 years married with growing children; and last stage is 45-55 years old or middle age with children who are attending college,” said Prof. Taipor.

Meanwhile, the Director of the Vocational Education Program Universitas Indonesia, Padang Wicaksono, S.E., Ph.D, said that the public lecture was very beneficial not only for students, but also for the general public. “The importance of literacy regarding insurance needs to be a concern for the general public, especially those who are not familiar with the benefits of insurance well,” he said.

He added, “Through the public lecture, we hope that the public can gain a good understanding of the use of insurance.” Also, said Padang, the collaboration between the Universitas Indonesia and Genovasi University College hopefully will continue and spark other collaborative innovations that can have a positive impact on society.